This article is the second of two posts for VC platform managers and investors, explaining how we have built a platform to help deliver global social and environmental outcomes.

In part 1, we broke down our platform components and explained the rationale behind the choices that make up our platform today, the challenges, performance indicators and what lies ahead.

This part 2 is dedicated to what we call our ‘Growth process’: this is essentially the process used to integrate and co-ordinate our platform components, and it is geared towards portfolio ventures achieving their ambitious economic and impact growth plans. A reasonable proxy for growth success in early-stage business is raising a top quartile series A funding round which, as lock-step businesses that they are, should be a proxy social and environmental outcomes performance. The growth process is by design self-serving and modular to founder needs (pull).

Onboarding — aligning expectations

Onboarding is the foundational step in our growth process, and this happens following the completion of our investment process (more on that here). Onboarding allows MSM to integrate a company into our portfolio and ensure lasting alignment. Onboarding is automated and based on efficiency and alignment (push — that is, MSM initiates this step, unlike the remainder of platform components designed to be self-service in nature).

The onboarding session is primarily about alignment, aligning on what success looks like, not just between ourselves and the venture, but also the other lead investors. It is not uncommon to see successor fundraises fail, as there is ambiguity regarding what success looked like. If we can establish this ex-ante, it helps ventures (and investors) focus on what matters. It also helps establish expectations about how we are all going to work together.

What? Onboarding is a collaborative session where we co-design with each venture, and main investors in the round, a clear forward-looking plan for each round of funding with milestones around product, traction, team and impact facilitated by the platform team with the participation of the main investors in the latest completed round.

So what? As a result of successful onboarding, it becomes clear for founders and investors (1) narrative and milestones for the next funding round; (2) impact case and metrics to be monitored; (3) ways of working together in terms of points of contact, monthly reporting and tools offered.

Tech-stack: Airtable, where we store the venture’s information and set up email automations and triggers that allow for an almost-self-service onboarding; Google meet, where the onboarding session takes place; tl;dv, where the session is stored and transcribed to be consulted asynchronously; Miro, where we have our founder’s journey mapped.

Main challenge: Onboarding is like the Sagrada Familia in Barcelona, a never-ending affair. Every time we add or change a platform component, we have to go back to the onboarding workflow and tweak it. It helps to have the founder’s journey designed.

What’s next? Connect the onboarding workflows with the portfolio management system.

Growth — scaling resources where they really matter

To assess if the companies are progressing well in their journey to fully achieving their business and impact potential defined throughout the onboarding, we triage our efforts where they are best placed. For that, we developed a prioritization framework that guides our internal quarterly growth sessions. This discipline gives us an overview of our portfolio’s performance, while it allows us to overcome the ‘iceberg effect’ of focusing only on what we can see, and make sure we are focusing on the obstacles that required attention, that are so often not immediately visible, and lurk somewhere beneath the deceivingly small and visible tip of the iceberg.

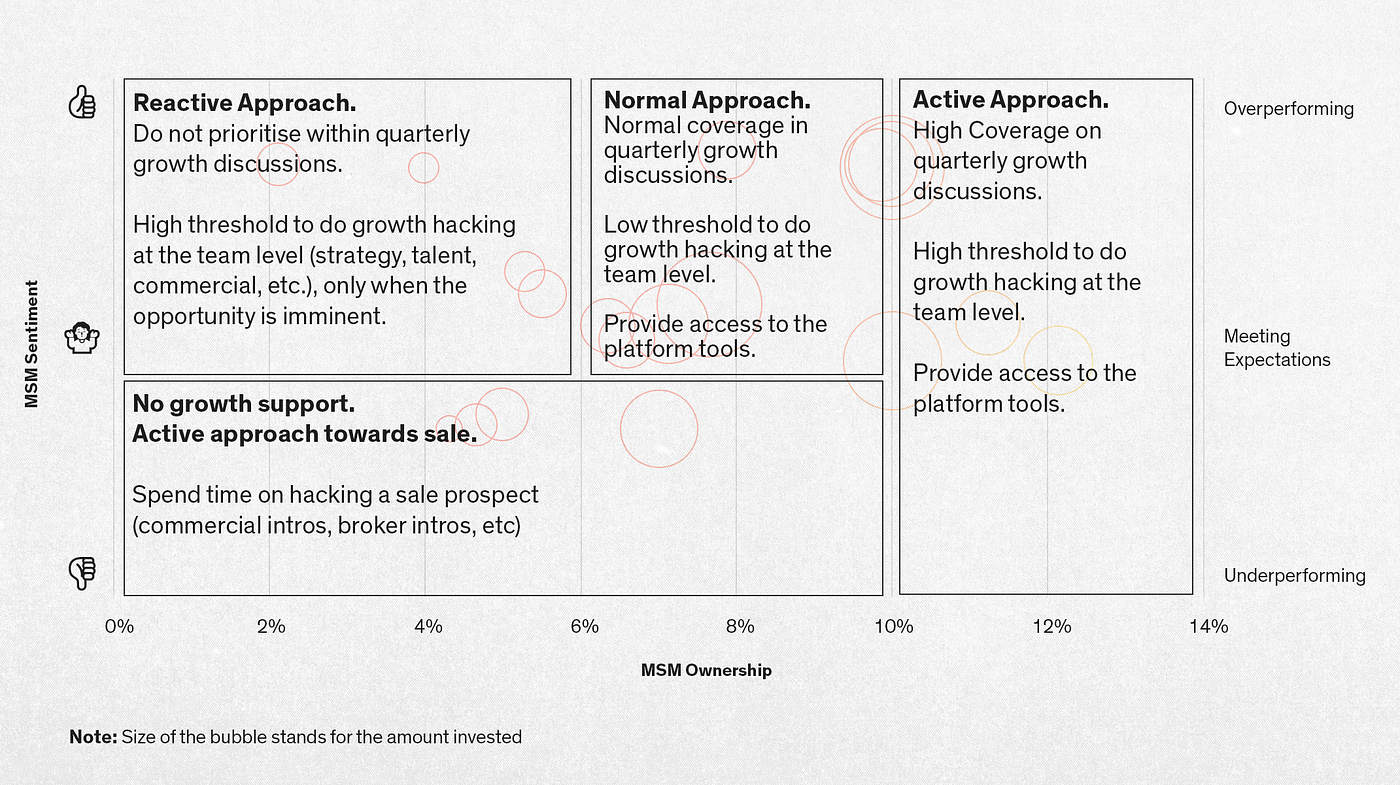

What? Every quarter, the MSM team, including our Venture Partners, monitors the performance of all investments vs. the agreed milestones in the onboarding session. Based on that, we rate our sentiment for each venture: thumbs up (exceeding expectations), shrug (meeting expectations) and thumbs down (not meeting expectations). Then, we analyze that in function of the amount invested (bubble size) and the current MSM company ownership (horizontal axis) of the companies as portrayed in the graph below.

So what? As a result of a successful growth meeting, it becomes clear where MSM efforts are best placed, or which actions we are to take to improve the overall portfolio performance as portrayed in the diagram below. We have seen that our discussion happens around two motions. A vertical motion on the right side, when we discuss how can we actively improve the performance of the companies we have more ownership. A horizontal motion, from the upper left to right, when we reflect if we want to strengthen the ownership of the companies that are overperforming.

Tech-stack: Rundit, where founders submit their quarterly financial reporting and we analyze real performance vs. target; Excel, where we analyze performance as a function of the amount invested and MSM ownership; Notion, where we prepare and debrief the meeting.

Main challenge: the tools are not integrated which still requires manual work for the preparation of the quarterly meeting.

What’s next? Continue running this framework to understand if it is truly helping us see the down part of the iceberg or if we have to tweak the approach.

Onboarding and growth are the glue that bring together all of our platform tools and assets. This is essential to help us better understand the quality of our investment decisions, and ensure we are scaling the platform’s efforts in the right places. The components of our platform, presented in part 1, exist to support our founders on their growth journey towards fulfilling their business and impact potential.

It is abundantly clear to us that no founder or company is alike and that it is impossible to deliver a platform-fits-all solution. VC is a people business and empathy cannot be automated. Repetitive tasks, however, can be automated giving us more time to focus on what matters: creating trust-based and empathy-driven relationships with our founders to help them succeed.

Enjoyed this post? Give it a 👏 below and check out other MSM articles on impact VC.

If you have any ideas, comments or thoughts on how to improve our platform for founders, please feel free to reach out to [email protected].