One of the most common questions we get asked in an initial call with founders is how our investment process works. Fundraising is one of the many tasks on founders’ to-do lists, however, many don’t enjoy the process. When we ask about financing round timelines, the answer is often “as soon as possible”, as founders are eager to put their heads down again and focus on building product and growing the business.

On top of this, many founders state that some VCs run opaque processes without providing visibility on timings and milestones. In a Point Nine survey, founders stated that the most stressful factor in raising from venture capital funds is not knowing where in the fundraising process they are, with many founders commenting that investors turn “radio silent” in the middle of the process. In this article, we break down what founders can expect from us.

* Note to self — don’t be Bill.

The MSM investment process is designed around 4 core principles:

1. Collaborative but conviction led: one of MSM team members needs to love what you are building. If everyone in the team thinks it’s good but no one thinks it’s great, it will not get through the investment committee (IC).

2. Transparent, direct, clear, and fair: no matter who the founder is, we try to be responsive and provide honest and timely feedback. Not wasting anyone’s time is on the top of our minds. We certainly don’t get this right all the time and continue to make errors here, but this is something we all aspire to do. We have a tracking process to help crack the whip on our responsiveness.

3. Founder focused: this is the single most important variable in assessing a venture, especially in the early stage. If we had to attribute an average percentage contribution for leadership towards IC decisions, it would probably be about 50%. At this early stage, we are in the business of backing people, more so than companies.

4. We get stuff wrong the whole time: just because we pass once, it doesn’t mean we won’t invest next time. Our process allows for iteration and if things change, we can revisit our decisions. This applies to OLIO, GoParity, Skin Analytics, to name a few.

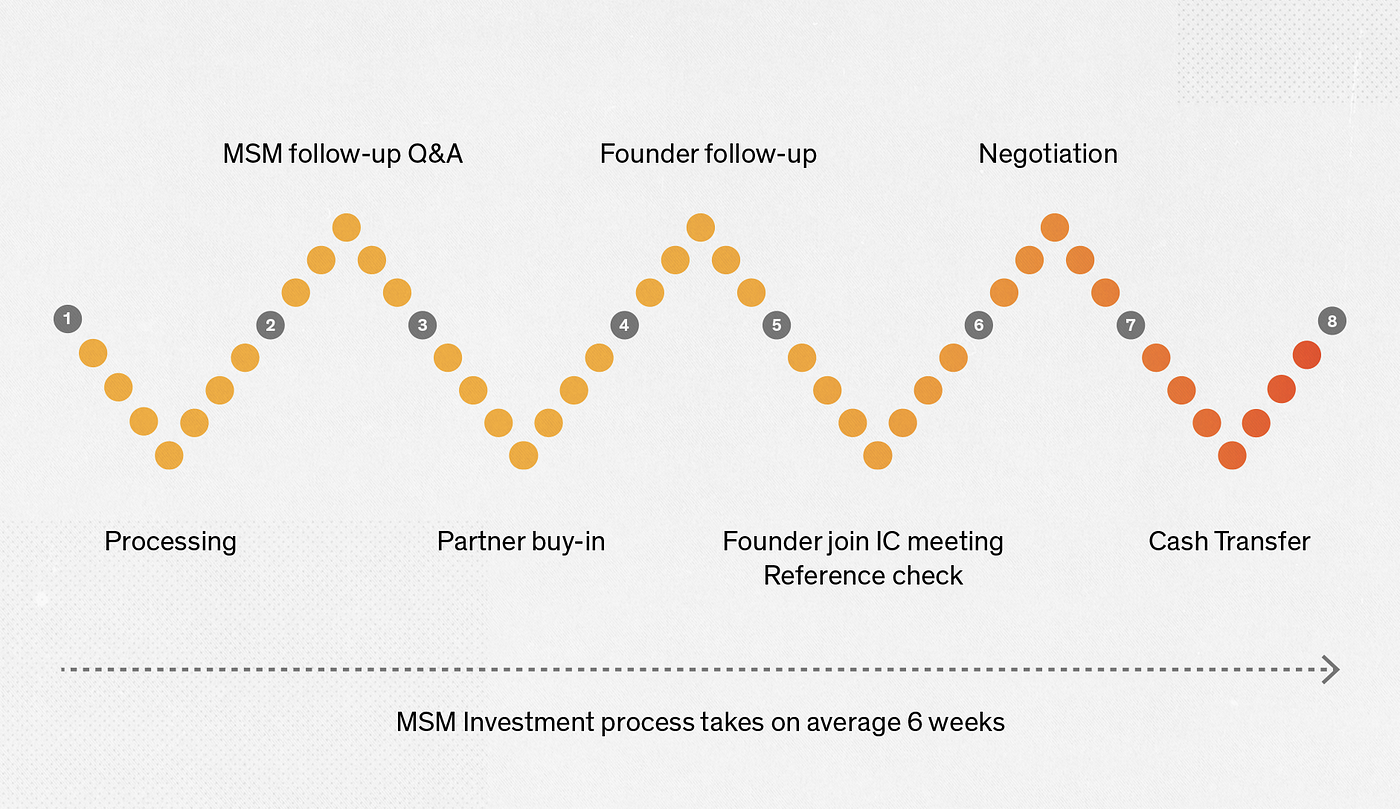

Before digging deeper, here are some numbers you might want to remember:

- MSM’s average time from 1st contact to IC decision is 6 weeks; and

- The shortest investment process we ever run took 8 (hectic) days. Kudos to the Mindstone team for bearing with us throughout the process 24/7.

The MSM investment process for new ventures comprises 8 steps (it’s not quite as formulaic and complicated as 8 steps, it’s more organic than this, but if we dissect how things happen, this is a fairly good representation) with several decision points:

© MSM

Step 1: Initial screening

MSM fosters a network of co-investors, accelerators, scouts, venture partners and founders that generate a high-volume pipeline for the investment team. On average, MSM filters more than 2,500 impact ventures per year, runs a diligence process in 90 of them, takes 27 to IC discussions and ends up investing in 13 ventures. This sourcing strategy allows MSM to have wide coverage of the European impact market. However, given the high volume at the top of the funnel approach, MSM relies on its growth tools to collect, organize, and filter information in a structured manner.

The first step after receiving an investment opportunity from any of the sources before-mentioned is to gather the initial information from the start-up in Affinity, which specifically entails collecting the pitch deck, geographic and sector information, and the founder’s data.

The second step is to analyse and process the data in the deck and make an informed decision on whether the business model fits the MSM investment strategy or not. This assessment, most often, looks at the market and impact potential of the venture. Can this business return the fund in its own right? Is it solving a global social problem in a novel and scalable fashion? The founders will be informed by email about the decision to progress or not with the process.

“We have always focused on the market — the size of the market, the dynamics of the market, the nature of the competition — because our objective always was to build big companies. If you don’t attack a big market, it’s highly unlikely you’re ever going to build a big company.” — Don Valentine, founder of Sequoia Capital.

Step 2: Initial call

When the decision from the screening process is positive, MSM organises a first call with the founders. The purpose of this 30 minutes call is to collect more data about the venture and meet the founding team. Founders should prepare for the following structure: i) 5 minutes presentation by MSM; ii) 10 minutes (max) pitch presentation by the founders; iii) 15 minutes of Q&A.

Besides collecting additional information about the different aspects of the opportunity, the core purpose of this call is to assess the founders and understand if there is an alignment between the founding team and MSM.

Step 3: Light diligence

After the call with the founders, if the investor sees potential in the opportunity and founding team, the process will continue. At this stage, MSM will collect and analyse additional information and build an internal risk and opportunity framework, which will inform a decision to continue or not the process.

This enhanced data collection can take different formats, depending on the main questions and risks identified in previous steps. Founders can expect an email with a more detailed Q&A, a request to access a data room, detailed business forecasting, a product demo, among others.

At the end of this stage, after analysing more detailed information, the investor will decide if she/he is still interested in progressing with the process. If the answer is positive, the investor will discuss the opportunity with one of MSM’s partners. If the partner is interested in the opportunity, the process continues, otherwise, the investor will inform the founders of the decision to pass and its core reasons.

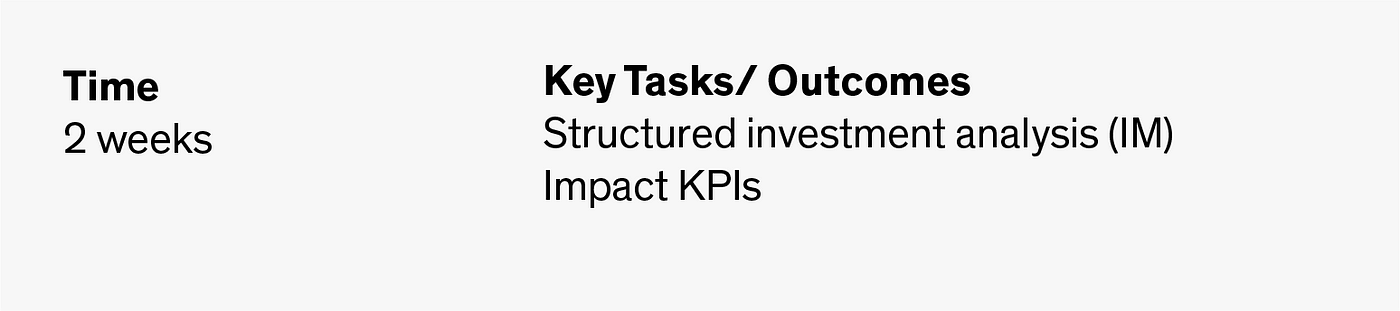

Step 4: Due diligence and IM

This step usually begins with a second call with the founders, where one of MSM’s partners is already involved. At the end of this session, the partner and investor analysing the opportunity will debrief and decide to pass or continue the investment process. If the feedback is positive, MSM starts a structured investment analysis with the goal to build an investment memorandum (IM), which will serve as a basis for the IC discussions.

This is the lengthiest step of the MSM investment process and can include several follow-ups with the founders and team to better understand some aspects of the product and business. It is also common that MSM starts the referencing process at this stage, in order to gather insights from customers and industry experts to support the investment case. MSM investment memorandums are focused on the following verticals: macro analysis, product, business model, go-to-market strategy, team, and impact. It is also at this stage that MSM proposes the impact KPIs that will be measured if the investment proposal is approved.

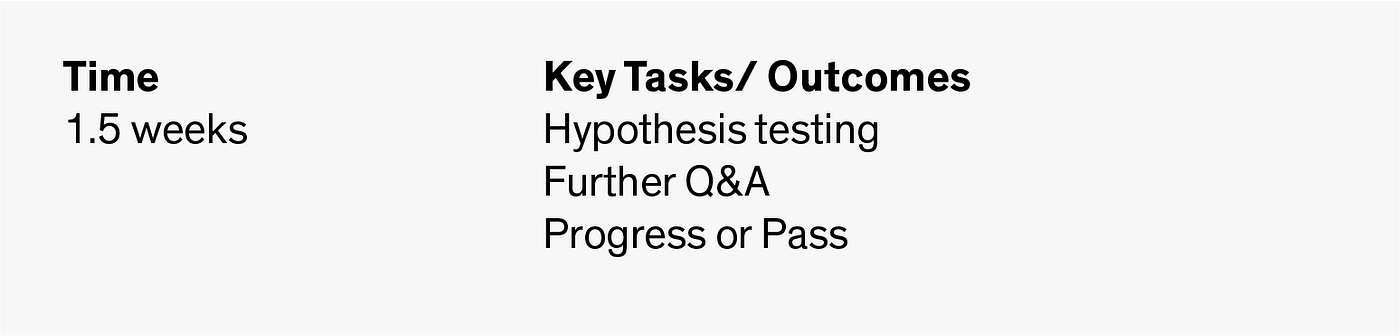

Step 5: IC discussion(s)

MSM IC meets twice per week, which allow us to iterate fast and be agile in our decisions. On average, it takes 3 IC meetings to discuss a venture before taking it to a final vote. Before the first IC session, the entire team reads the materials (IM and investment deck) so that the discussion is focused on a productive exchange of ideas and scrutiny of the investment case.

After this first session, the investors leading the opportunity will follow up with the founders and collect additional data points requested by the MSM team. Typically, the MSM team will have a second debate, decide if they are interested in meeting the founders, and discuss how to start the founder’s reference process. The final IC meeting includes the founders, where both the MSM team and founders can ask questions directly. As Marc Andreessen rightly points out “Particular investors who are going to be on the board for the company, are just as important as who you get married to”. This is by no means fail-proof, but it is a critical step in making sure we get the marriage proposal right.

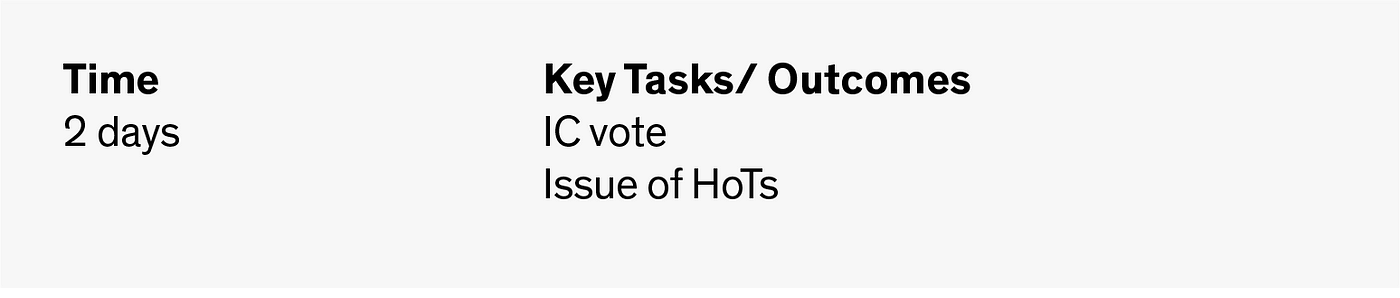

Step 6: IC vote and term sheet (HoTs)

After meeting the founders, if all team members are comfortable in bringing the Company to an IC vote, the lead investors will share the main terms of the investment proposal with the team for a final vote. The IC has 2 business days to review the main documents and vote. Note that before taking a venture to IC vote, the MSM team can jointly decide to pass the opportunity. It is possible for a partner to proceed regardless, which is typically a measure of extreme conviction, and whilst we like to be collaborative as a team, we prize conviction.

The MSM IC voting process is based on the average of the NPS scores (1 to 10 scale) of the entire team. An investment is approved if the average is above 7 and the leading partner votes a 9. If the investment is approved according to this framework, the lead investors will send the HoTs proposal to the founders within days.

© MSM voting system

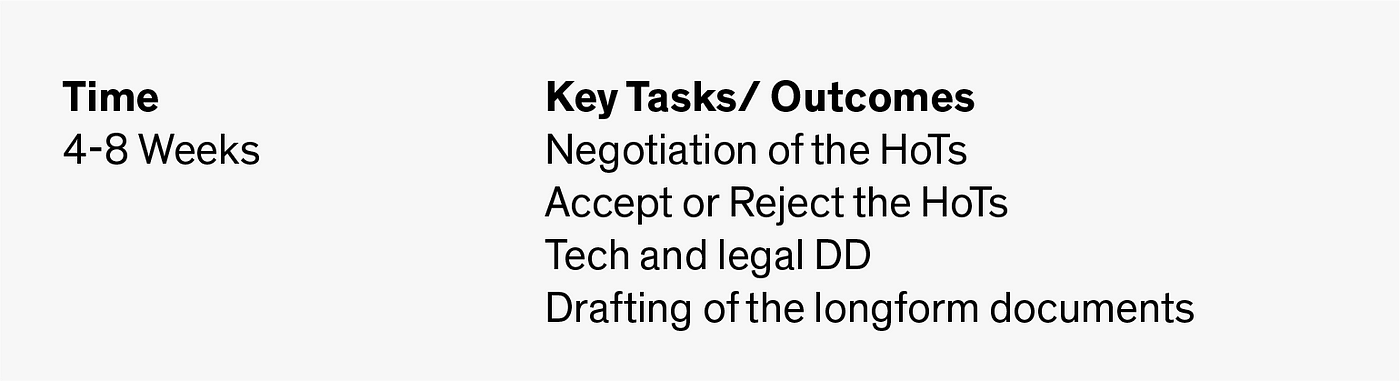

Step 7: Closing

The MSM lead investors and the founders will negotiate the term sheet proposal, leading to a final decision from the founders to accept or reject the offer. If the founders accept the HoTs proposal, the drafting of the long-form documents begins, such as the legal and tech due to diligence process. This step can vary in time, depending on the progress of the remaining investors that will join the round.

Following the signing of the long-form documents, MSM will transfer the corresponding investment amount.

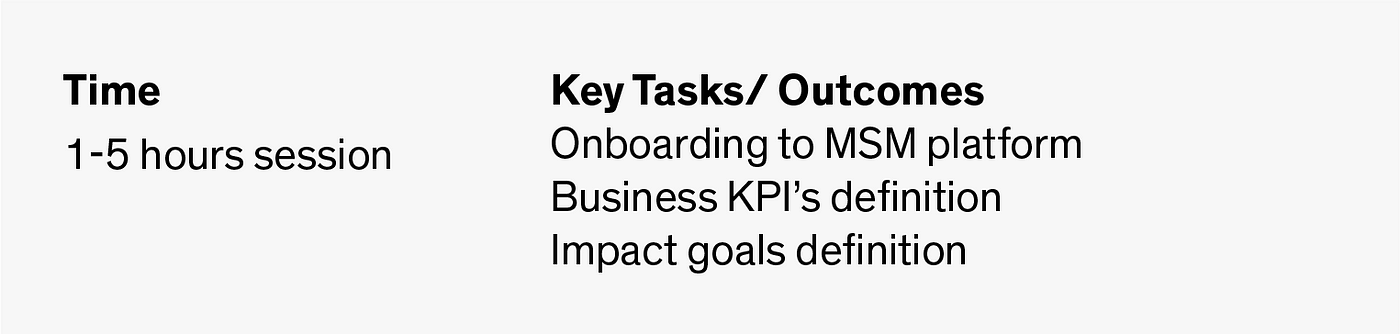

Step 8: Portfolio integration

The final step of the investment process takes place when the venture is integrated into the MSM platform. This step consists of an onboarding session, where the founders, MSM, and other co-investors (selected by the founders) define i) business KPIs, ii) impact KPIs, iii) reporting requirements, and iv) ways or working together. It is also in this meeting that MSM presents the growth platform to the founders and its perks (more information on our platform coming soon).

Our investment process is probably the single most important driver of returns, it is also one of the very few things within our control. As Seth Klarman puts it, “You can only control your process and approach”. We know there is room for improvement — if you have any questions or thoughts on how to make our process better and leaner for founders, please feel free to reach out to [email protected].