The hope is that we are all going to live longer, yet it is not at all clear people are living better longer. Empirically speaking, Eurostat measures the number of healthy life years at the age of 65, which increased 1.6 years to about 10 years between 2005 and 2018. Life expectancy increased 2.6 years in the same period — for these additional 2.6 years we are living, 1 is unhealthy.

Ageing demographics present a number of challenges not least that in Europe alone it is predicted that old-age dependency ratios (the number of elderly dependent from working-age individuals) will grow from 32% today to 52% in 2050, and 57% in 2100 (Eurostat). Compounding that with young dependents, by 2050, for every 4 adults working, there will be another 2 retired seniors and 1 individual too young to work (Eurostat). Dependency economics aside, ageing has been associated with an explosion in loneliness, owing to globalised and fragmented communities: AgeUK expects a 49% increase in over 50s feeling lonely between 2016 and 2026, without even considering the impact of the CV19 on isolation. It is hardly contentious at this point that more needs to be done to serve what is rapidly emerging as a major humanitarian crisis, and it is perhaps equally unsurprising that we should expect innovation in how we as a society take care of those who once took care of us.

It is instructive to note that decreasing active populations are closely tied to economic and financial downturns — economic recessions are often associated with declining active populations (FT / UBS Investment Research), and low growth environments have been highly linked to aged demographic structures (Fed). Not only is ageing a clear and present humanitarian issue, there are also important second order economic implications, both of which make this area of critical focus for impact venture. And this is precisely why the team at MSM has been particularly keen to find solutions that help our grandparents live better for longer.

Parar é morrer, a traditional Portuguese saying. To stop is to die.This memory comes to mind when describing what is happening to our elderly’s physical and mental health under the current isolation policies in place.

To the best of our research efforts, we seem to have the elderly on the side of our thesis — or at least so says our grandparents. Long gone are those independent active days for my grandmother, but her desire for some sort of autonomy is still there — she is clearly strongly against anything close to resembling a long-term care home service, and she is equally averse to the idea of being a family burden. When looking for solutions in the elderly care space, our starting premise is that autonomy and active living are key drivers of life quality. We hope to see the elderly aging happily at home for as long as possible.

In our research in this area, we stumbled across this very complete reportfrom The Gerontechnologist and tried to summarise it into the segments that are most relevant to our mandate of high growth, scalable, tech companies whilst having an immediate senior living impact:

Hardware / IoT, which we grouped as follows:

- (i) Wearables

- (ii) Home IoT monitoring devices

SaaS B2B, which we focused on the following:

- (i) Care management tools for home care providers

- (ii) Marketplaces for care service agencies

Tech-enabled B2C, which we focused on the following:

- (i) Tech-enabled professional home care providers

- (ii) Peer-to-peer caregiver staffing services

Hardware / IoT

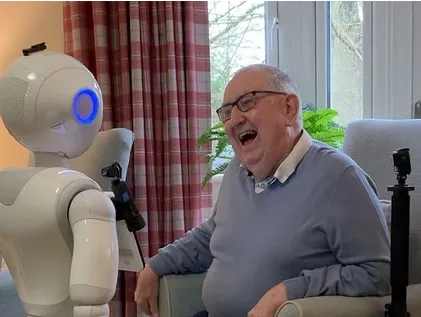

Technology penetration within the elderly is at all-time highs (77% use a smartphone, 17% a wearable), and only expected to increase in the coming years, but the wider adoption of wearables and home assistant services felt to us a reality still too distant for our mandate time horizon. Imagining our elderly covered in wearable gadgets and their houses filled with monitoring devices does not look like a realistic near-future scenario, and there are certainly elements of this vision of the future which are downright dystopian and wholly unagreeable! Some will call it conservative, but we do take some of these dystopian elements of robotic elderly support as creating other wider problems of loneliness and tech dependency. Seeing some of the best players in the hardware space (Apple and the likes) trying it and not being particularly successful, illustrates the significant capex and distribution challenges, and makes our ex ante likelihood of finding a winner in this space relatively low. User adoption will likely change with time, as the next generation is more tech-engaged than the previous, but this is beyond our time horizon and our own views of gracefully ageing.

SaaS B2B

We are impressed by the efficiency gains provided by deploying SaaS care management software to old-school home care and making these mostly offline businesses visible in online marketplaces. Business models building the technology infrastructure needed for care providers to deliver better care lends itself well to a scalable growth opportunity. Note Birdie, a domiciliary care management software sold to home care providers, as an example in the UK. That said, we are yet to find the early-stage venture opportunity in this segment, likely due to the already evolved stage of the leading players in this category.

Tech-enabled B2C

From a consumer perspective, thinking of what services we would like to offer our grandparents, or even in the longer-term, what services we would like to use ourselves one day, we are sold on the concept of using technology to make the current human-led home care support better and more accessible. We see it becoming an enabler of elderly autonomy and promoting more active lifestyles. We see this as the antidote to two particular service offerings in the industry — long-term care home services, and the robot-driven approach — both of which we generally find rather depressing. There are a number of emerging home care providers, including the likes of Elder, Lifted, or SuperCarers in the UK, and Honorin the US. Within the lower complexity companionship services space, we note Papa in the US, OuiHelp in France, and Helpper in Belgium. We like this space, we think there is true root-cause/solution potential, it is scalable and growing rapidly. It is this line of thought that led us to Careship.

Careship is a German caregiver platform for companionship care. It matches elderly people in need of non-medical companionship with vetted high-quality caregivers. We see a material opportunity to deliver a better offline experience than the current providers via an online tech-enabled solution — an online-to-offline journey that builds community.

The focus on a lighter version of elderly care, provided at earlier stages of the aging process presents exciting opportunities for Careship. It removes the technical skill requirements to access supply of carers (reducing supply barriers) while reducing the cost of service (augmenting the target market). It broadens the scope of their senior customer base to more than geriatric patients. And it allows Careship to become the enabler of a longer independent life for its seniors. Careship’s clear acquisition strategy of caregivers mainly through university students (cash strapped) and recent retirees (time abundant), and its smooth integration with insurance reimbursements are valuable insights we find in this team.

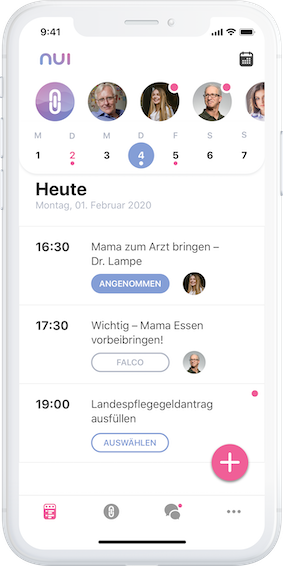

Nui Care is also a German-age tech start-up and is a further MSM investment in the category. Nui Care is a content — training, support, family management — app for informal caregivers. Informal caregivers are anyone taking care of someone in a non-professional way — an employed or unemployed family member or friend, a group as large as 12% of the population in Europe. We found in Nui Care’s product vision the answers to most of the questions we would ask ourselves when given the task to take care of our elderly. Its service aims at helping families manage the care of their elderly — through a family-managed tool — while providing educational content and live support to the informal caregivers

Nui’s view of a content platform as the first resource for informal caregivers resonates with MSM’s view of democratising access to care education content, while at the same time providing the scale returns only a content platform can offer. Its early progress with insurance companies and employee benefits teams appears to validate a meaningful information gap in the market for the simplest level of care.

Both teams shared a similar vision to ours regarding what senior care should look like — a personal service, promoting elderly autonomy to individuals that are yet to totally lose their full autonomy, via human interactions and strong integration in the community.

We, as informal family caregivers now, and as future seniors later, find both Carehip and Nui Care’s offering compelling from an improved independence and improved support standpoint. Parar é morrer — we continue to seek great solutions in this space, spurred by the restlessness of an active life.

*****

If you are an entrepreneur launching a business to solve a social or environmental challenge looking for funding, let’s talk. To speed things up, reach out to me (Manuel) directly via email with your pitch.

Mustard Seed MAZE (MSM) is an impact Venture Capital fund that invests in the great businesses of the future, those that profit from solving social and environmental challenges. MSM targets fast-growing European ventures with global lock-step potential where impact and financial returns are mutually reinforcing from pre-seed to series A.