Incentives are everywhere and dictate our behaviour, as individuals and as organisations. The energy transition that we are currently witnessing is a great example of this, whereby an increasing adoption of renewable sources of energy or electric vehicles is a result of tax and monetary incentives, shaping the behaviour according to the goals of policymakers (and to the benefit of our planet).

At the Mustard Seed MAZE (MSM) fund, we are building a European portfolio of early-stage ventures that are disrupting industries and sectors based on a common denominator: their revenue models are intrinsically linked to the positive social or environmental outcomes that they create. We call this lock-step venture. As revenues grow, impact grows, and vice versa.

We are proudly an impact venture capital fund at our core. For us, incentives matter a lot and we have designed our remuneration mechanism as fund managers accordingly, by placing equal incentives on both the financial and impact performance of our portfolio. Whilst impact narratives are fortunately becoming prevalent, we feel it is fundamental to see an alignment of economic and impact incentives if the sector is serious about driving lasting social and environmental change.

How MSM incorporated impact into its remuneration mechanism

Typically, fund managers of venture capital funds receive a 20% performance fee based on the net proceeds of the fund that they manage. In simple terms (excluding hurdle rates, taxes, or other fees), if a €30m fund delivers a 3x Multiple on Invested Capital, the net proceeds are €60m, of which 20% (€12m) are paid to the fund managers to remunerate their performance, with the remainder (80%) being paid to LPs. The incentive is to focus on increasing the financial value of each company. In this mechanism, there is one currency: money.

We have adopted a mechanism that includes impact performance as a key eligibility criteria for any remuneration. In essence, we are only entitled to our performance fee, if, and only if, we reach a minimum threshold of impact performance across our portfolio. It works as follows:

– For each investment, we define one or two impact metrics that reflect our investment thesis, i.e., an impact metric that is linked to the revenue model of the company. We adopt the framework of the Impact Management Projectfor this purpose.

– For each metric, we establish annual target goals, that are quantified. These metrics and goals are proposed to an Advisory Board, comprised of our main LPs, who approve them (or not).

– The impact mission of each venture is added to their Articles of Association. The regular reporting of the performance on each impact metric, against the established target goals, is embedded in contractual agreements at the point of investment.

– Based on this, at any point in time, we can calculate for each company what is the ‘impact multiple’: the ratio between the target goals established at the time of investment and the performance at the time of calculation.

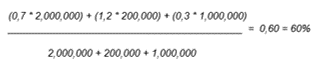

– From a portfolio perspective, we can calculate at any point in time the ‘portfolio impact goal’, which refers to the weighting of the impact multiple of each venture with the capital invested in each venture.

As a result of this mechanism, we at MSM are only entitled to receive any carry above a ‘portfolio impact goal’ of 60%. This means that regardless of the financial performance of our portfolio, we will receive €0 if the ‘portfolio impact goal’ of the portfolio does not reach 60%. Above that threshold, we are entitled to 50% of our performance fee, upwards of which then follows a linear scale. There are two currencies: money and impact. We are incentivised to deliver and maximise on both.

Putting this mechanism in practice

For ease of reference, please see below how this mechanism works in practice, assuming a calculation made 4 years after the first investment in three companies. The figures are for illustrative purposes only.

Student Finance: impact factsheet here

Omocom: impact factsheet here

NuiCare: impact factsheet here

Summary table — impact multiple

Based on the table above, the ‘impact portfolio goal’ at year 4 would be calculated as follows:

For remuneration purposes, at year 4, the ‘impact portfolio goal’ would be 60%. As this is the minimum threshold for MSM to be entitled to start receiving the performance fee, this would mean that had there been any net proceeds of the fund, we would be entitled to 50% of our full remuneration.

A core element of MSM’s impact mandate

Throughout our work over the past eight years, we have had important learnings that influence how we invest and operate:

Impact is not binary. There are several gradients of impact, and a variety of strategies should be embraced and celebrated. We do not find relevance in conversations based on the premise ‘my impact is bigger than yours’.

Impact is made, not found. We back ventures whose impact potential, given their early-stage nature, is not fully accomplished. We are comfortable with this and in taking impact risk where the impact upside at scale overweighs the initial risk. That is how we will breed the defining companies of tomorrow.

Every investment has an impact, positive and/or negative. As a result, it is our belief that impact funds should not only defined by the impact characteristics of their portfolio, but also by the incentive structure underpinning their investment decisions.

Linking our remuneration to the impact performance of the founders we back is our way of demonstrating our full commitment to the impact mandate that has been placed on us by our LPs and honour their support.

Our commitment is also towards the ecosystem as a whole:

(i) If you are fund manager looking to incorporate impact into your internal processes, we are very happy to share our learnings in more detail.

(ii) If you are a founder looking for a partner whose incentives are fully aligned with yours to create a lasting impact on the world, we are here for you. Please feel free to reach out at [email protected]