We hardly ever hear someone questioning how accurate a given business’ revenue figure is — so why do we do so in carbon accounting all the time? In this article, we break down the tech stack that can either improve or compound carbon measurement error. The truth matters as it underpins the credibility of natural capital stewardship.

Most carbon accounting exercises aim at arriving at a footprint estimate. This estimate will most likely always be an estimate, as it is uncommon to find CO2 metering infrastructure allowing us to measure the exact emissions of a certain item or service. The question is how close that estimate can be to reality. Or alternatively, why do we even care about how close?

Level 1: How are carbon emissions measured?

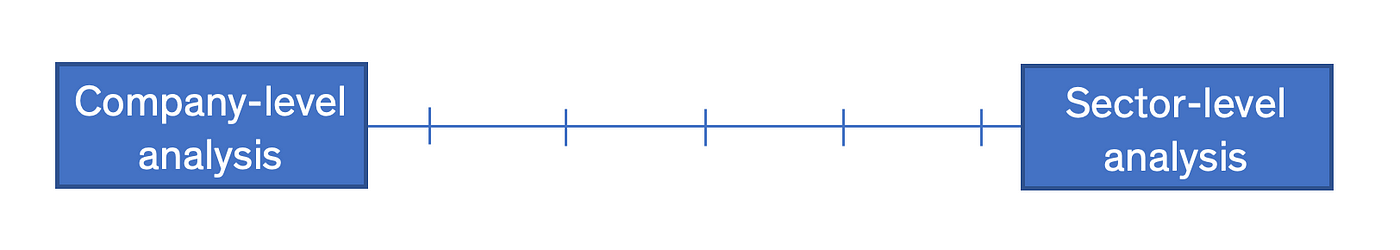

Today’s measurements rely on datasets that relate very little to the given item or service purchased. Think of your latest coffee at Starbucks — the emissions estimate currently presented to you for this expenditure is most often sourced from sector-level emissions databases (e.g. the ‘food and beverage’ industry average emissions per $ spent), as opposed to CO2 metrics of this particular merchant, or their own supply chain.

There are multiple levels of granularity achievable when estimating this carbon number:

- The macro sector-level analysis of carbon intensity.

- The micro company-level analysis on a given product carbon intensity.

- And all iterations or approximations in between — e.g. instead of using the whole sector, to use only comparable peers/products, etc.

Carbon accountants — being it human-led accountants or tech-driven service providers — help businesses measure their own footprint to a greater degree of certainty than one would otherwise reach by simply applying sector-level averages. Apart from the conventional accountant work, human-led, some tech-enabled players — e.g. PlanA, Normative — have now begun to develop sufficient scale to build their own bottom-top databases of peer-level data (e.g. a bespoke customised dataset on coffee stores, as opposed to the food and beverage sector as a whole).

Although a lot is being done to measure emissions more accurately, carbon accounting is still very much an estimate — very often based on those top-bottom sector averages, as opposed to company-specific metrics.

Noticing how carbon measurement is becoming such a hot topic, while carbon estimates still seem so uncertain, means a lot of the focus seems to be on offsetting emissions or reducing consumption activity and not necessarily in finding more carbon-efficient solutions — i.e. whether the correct real number is 1x or 10x what’s measured, the focus is in offsetting emissions or reducing emissions through stopping activity, not in finding less emissions-intensive suppliers. This lack of accuracy in the scale certainty makes it hard to compare apples to apples when benchmarking suppliers, making it impossible to choose one provider over the other. Basically, spending $100 on a Patagonia sweater yields the same CO2 calculations as spending $100 on 10 t-shirts from Primark, which just isn’t right.

There are some sector-focused players working in addressing these accounting problems with a focus on a specific industry — e.g. food accounting (CarbonCloud), electricity (Tmrow), farmland (CarbonSpace). Others specialise in measuring one’s supply chain — e.g. Proof of Impact(doing so through IoT), Aklimate (a supply chain dashboard), SupplyCompass(a fashion supply chain management).

The core consideration when looking at supply chain is to move from a sector-level analysis (i.e. “we spend $100,000 per year in couriers”) into company-specific analysis so that the dialogue about better sourcing and better procurement becomes more relevant. The moment the analysis becomes a company-level approach, data accuracy becomes essential — whilst when it is on a sector-level, the focus should be consumption reduction, making the data accuracy point less relevant.

This question around the sizing of carbon intensity of a given business — and the uncertainty on whether the real figures are 1x or 10x those estimates — builds an important case of a potential conflict of interest behind businesses selling carbon offsets after measuring one’s carbon footprint. If uncertainty is acceptable in this space, the potential of profiting by presenting the top-end estimate can easily be perceived as a risk to data accuracy.

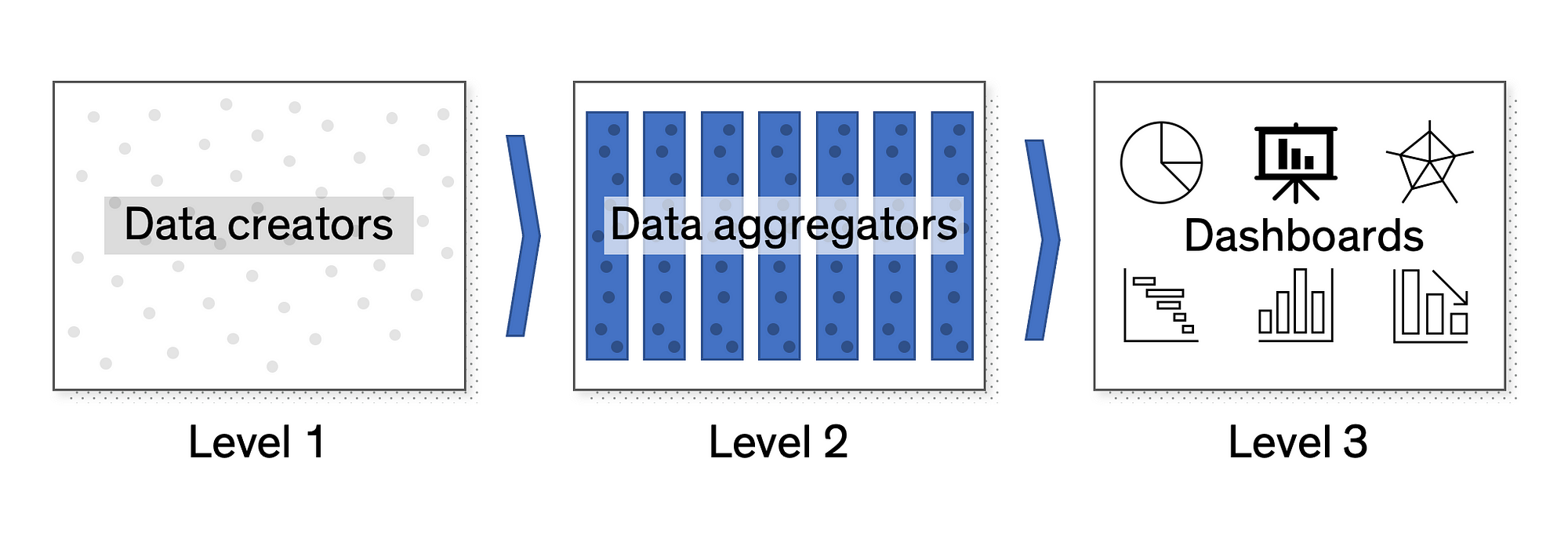

Level 2: How is data on carbon emissions aggregated?

As discussed, the first level in the carbon accounting tech stack is to identify the most suitable emission factors to consider (either sector-level, company-level, or somewhere in between). These are spread across multiple sources — some more niche, others more generalised — which means for scalable consumption of the most accurate data, it is helpful to aggregate all this data into a single data source or data provider. This takes us to the second level. Ventures like Climatiq and Connect Earth are doing this aggregation effort, which is then leveraged by carbon accountants, corporates, investors, and consumers — and all stakeholders interested in carbon accounting who will then more easily use the most appropriate data set for their emissions calculations (as opposed to the most generalist, but least specialised).

Whilst the venture space in level 1 will be led by players finding the most bespoke and accurate datasets in a scalable manner, in this second level the focus will be on those building the best platform to aggregate and distribute as many datapoints as possible, and integrate others in the most scalable and efficient way.

Level 3: How to manage the carbon emissions of a company?

Being in control of the best data, it is now up to the end client — the corporate, who is the ultimate polluter — to ensure these datasets are used to (a) measure their own carbon footprint and (b) manage that footprint regularly. It is worth noting that many solutions combine (a) and (b) in the same product, although others do not.

”You can’t manage what you can’t measure.” The measurement is just about applying the datapoints collected from level 1 and 2 to the specific businesses being measured. The management is all about finding ways to reduce a company’s carbon footprint. Companies like Planetly, Sweep, Persefoni, PlanA and Normative actively help businesses reduce their carbon footprint (aiming to achieve net zero). Data visualisation, and insightful recommendations are the deal breaker for solutions in this space, as ultimately ventures will be assessed on how much usage these get, and how much impact they created for their client.

The pursuit of truth in carbon measurement is central to managing the climate externalities generated in production and consumption. At MSM we see this space as a mission-critical utility for improved carbon emission management. We believe that the winners in this space will be those that distinguish themselves in their carbon estimate accuracy — which will mean level 1 players that differentiate through accuracy, level 2 players that differentiate through broad high-quality data sources, and level 3 players that deliver quantifiable reputable carbon management recommendations. Better estimates means better measurement which means better management. Drop me a line if you’re building something in this space (manuel at msm.vc).